As the EU aims to be climate-neutral by 2050 the carbon emissions that buildings are allowed to emit per year decrease—so depending on where your emissions fall in relation to this target, you may experience transition risks or stranding.

With carbon budgets rapidly decreasing, asset managers and developers need to think strategically about protecting their buildings against the risk of stranding, as well as other transition risks.

But how do you know which assets are at risk? And how do you create mitigation plans in line with key regulations, compliance requirements, your own ESG targets, your investment strategies and business plan? In this article, we cover everything you need to know about identifying and avoiding asset stranding and transition risks—and why it’s crucial to act now.

What is asset stranding?

Asset stranding occurs when an asset loses value (or even becomes obsolete) due to misalignment with key carbon emissions targets. Once a building’s emissions are above a certain threshold, it’s considered “stranded”, because it’s exposed to regulatory risks and it’s no longer in demand or economically viable to maintain.

As each country aims to reach net zero by 2050, the carbon emissions that buildings are allowed to emit per year decreases—so depending on where your emissions fall in relation to this target, you may experience transition risks or stranding.

This also means that assets that aren’t at risk of stranding today may be at risk tomorrow, because the requirements become more stringent over time in line with decarbonisation goals.

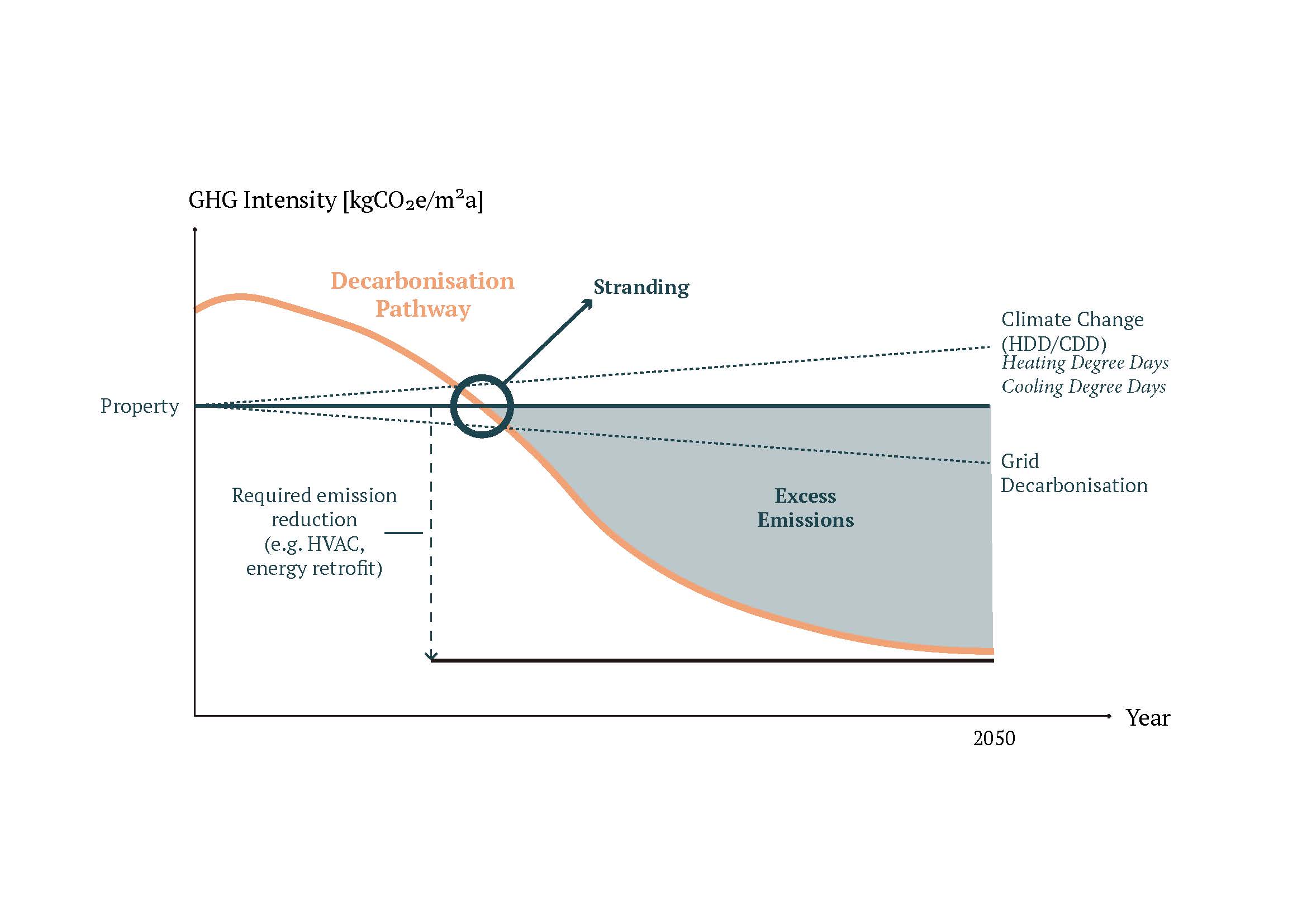

The Carbon Risk Real Estate Monitor (CRREM) graph below provides the commercial and residential real estate sectors with transparent, science-based decarbonisation pathways aligned with the Paris Climate Goals:

Stranding Risk and Excess Emissions, Source: CRREM

Knowing where your asset falls on this curve is key to understanding its risk and value.

- If your asset is below the curve: Your asset has a green premium, which means its high sustainability performance increases its value and desirability

- If your asset is on the curve: At this point (known as the stranding year), your asset emits as much carbon as the budget allows, putting you at risk of stranding if you don’t act fast to address the issues

- If your asset is above the curve: Your asset has a brown discount, which means its value is rapidly depreciating due to its poor operational performance

Why you need to be aware of assets at risk of stranding

It’s crucial that investors and developers are aware of assets at risk of stranding so they can maintain both immediate- and long-term value, stay compliant with key regulations and legislation, and contribute to climate goals.

Future-proof your investments

Making your assets more sustainable protects your investments, creating long-term value, demand, and investor appeal.

One study found that 40% of European pension funds reported depreciation of 21–30% due to brown discounting on commercial real estate assets, while 18% saw this depreciation figure rise to 31–40%. On the other hand, 79% of those same pension funds expect commercial real estate with good ESG credentials to deliver better returns over the next five years.

It’s clear that ESG criteria and building safety standards are only becoming more important in investment decisions. In particular, certain types of investors—for example, those looking to integrate an asset into an Article 9 SFDR fund —will automatically have a set of sustainability requirements that your asset must demonstrate to even be considered.

Many investors are looking for buildings with a green premium to reduce transition risks and ensure they’re getting the best long-term value—so ensuring your assets meet these requirements is a sure way to maximise their attractiveness well into the future.

Reduce carbon emissions and costs

Once you have a clear, data-backed understanding of your assets, you can improve energy performance and reduce emissions for at-risk buildings to stay ahead of the curve.

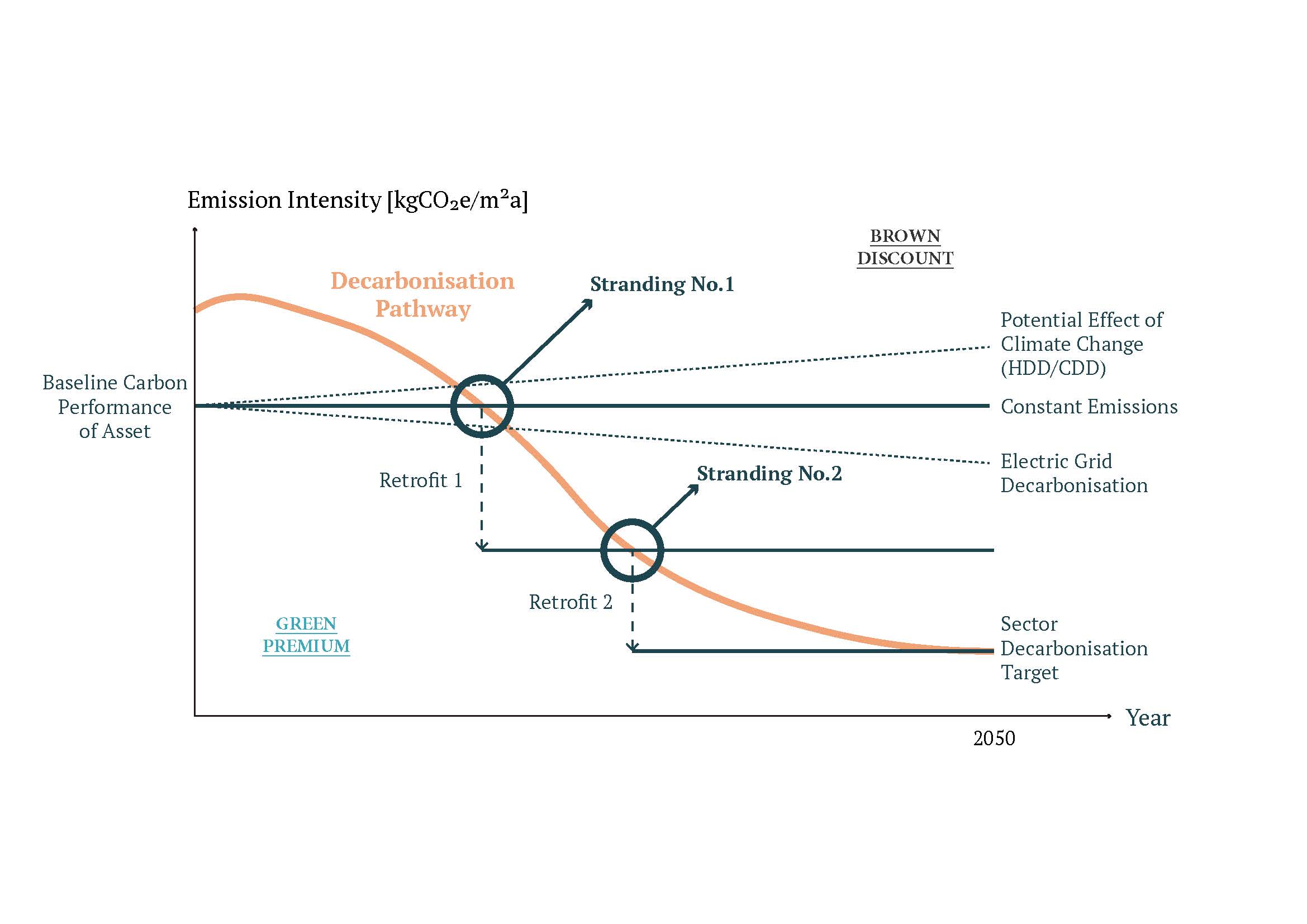

Retrofits and Decarbonisation Pathway, Source: CRREM

Not only does this contribute to a greener, safer, more sustainable built environment and improve the value of your asset: it saves money, too. By reducing the operational energy, you also reduce ongoing costs, delivering an even stronger return on investment.

Make informed decisions

Knowing which buildings are at risk of stranding or transition risks enables you to make strategic, informed decisions about how to prioritise your resources (such as budget and labour) across all of your assets.

This allows you to understand when—and how—to retrofit, decarbonise, and improve your assets to optimise their value and stay aligned with the targets across the entire lifecycle of your building.

For example, you can identify which changes to make now to unlock instant impact and which ones to make later, when technologies will be more advanced, accessible, and cost effective.

How to identify assets at risk of stranding

To identify assets at risk of stranding, you need to look closely at current and upcoming regulations and legislations to understand how your buildings perform against their targets (such as carbon emissions).

There are a few frameworks you can use to do this. One methodology is CRREM, which is used to calculate operational carbon and takes into account the location and typology of the asset to situate it on the curve we saw above.

But there are some criticisms of CRREM as a methodology. Because it measures only the operational carbon and it’s based on the behaviour of the asset’s occupants rather than on the characteristics of the underlying asset itself, meaning it doesn’t always give the clearest picture.

Using a framework like EU Taxonomy gives you a more concrete way to quantify the performance of your building. It’s an alternative and more objective pathway to show that an asset is sustainable because it offers comprehensive guidelines: assets are either taxonomy-aligned or they aren’t.

And as we’ve seen, when assets are aligned with EU Taxonomy, they’re not only more sustainable—they also unlock a whole host of benefits, from reduced operational costs to increased market appeal and eligibility to Article 9 SFDR funds.

How to avoid and mitigate asset stranding in 3 steps

So how do you stay ahead of the curve? To avoid asset stranding and mitigate transition risks, you need to first assess the current performance of your buildings and how they compare to targets. From here, you can identify which assets are at risk of stranding—and which ones you can come back to in ten or twenty years.

Working with trusted consultants and experts such as Catalyst, you can create a decarbonisation roadmap or net zero roadmap which outlines exactly what you need to do to these at-risk assets in order to meet the criteria.

Then, use that roadmap to create an implementation plan that suggests improvement measures and splits those measures across the entire lifecycle of the building.

The right roadmap and implementation plan ensures you always stay in that “green premium” sweet spot, keeping investors happy, maintaining your assets’ market value, and reducing financial and environmental risk.

Looking to the future

The real estate industry has an opportunity—and a responsibility—to bring existing building stock into the future with us, particularly in Europe where we have such a high supply. Instead of always looking to create new buildings from scratch to net zero specifications, we can work to transition the existing stock to meet these environmental standards.

By identifying assets at risk of stranding and proactively mitigating transition risks, you can ensure your investments stay marketable, profitable, and sustainable. Using the frameworks and steps outlined above, investors and developers can increase their asset’s value while reducing its climate impact, maximising ROI while contributing to a safer, greener built environment.

Want to learn more? Get in touch today to learn how Catalyst can help.